36+ how much income for a 500k mortgage

Keep in mind these amounts only include principal and interest. Web In general if you have a 100000 mortgage on a house thats worth 550000 the value of the house is also called the replacement cost your lender requires that you.

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

Your total interest on a 50000000 mortgage On a 30-year mortgage with a 700 fixed interest rate youll pay 69754449 in interest over the life of your loan.

. Keep in mind an income of 113000 per year is the minimum salary needed to afford a 500K mortgage. The mandatory insurance to protect your lenders investment of 80 or more of the homes value. This is a rule of thumb and the specific salary will vary depending on your credit score debt-to-income ratio.

130000 12 1083310833 x 032 3447. At 45 your required annual income is 56557 Maximum monthly payment PITI 124670 indicates required. Web The 28 part of the rule is that you shouldnt spend more than 28 of your pre-tax monthly income on home-related expenses.

In that case NerdWallet recommends an annual pretax. Web The traditional monthly mortgage payment calculation includes. The cost of the loan.

Ad Get Pre-Approved For a Mortgage and See How Much. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000.

Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income. Web In this scenario the minimum income needed for that 500000 condo is 113000 or two salaries of 56500 per year. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment.

Web As a general rule of thumb lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income which can be approximately 41. The 36 part is that you shouldnt spend more than 36 of your income on monthly debt payments including your mortgage credit cards and other loans such as auto and student loans. Web How much income is needed for a 500K mortgage.

Use this mortgage income qualification calculator to determine the required income for the amount you want to borrow. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal interest taxes and. Web In this scenario the minimum income needed for that 500000 condo is 113000 or two salaries of 56500 per year.

Web Need to figure out how much income is required to qualify for a mortgage. 113000 12 9417 9417 x 032 3013 Expenses 2982 3013 GDS Keep in mind an income of 113000 per year is the minimum salary needed to afford a 500K mortgage. This could also be two salaries of.

Web A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total annual income. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Web To purchase a 300K house you may need to make between 50000 and 74500 a year.

113000 12 94179417 x 032 3013. Expenses 2982 3013 GDS. The amount of money you borrowed.

With your monthly household expenses amounting to 3442 this means the required minimum income for a 500K mortgage under the Stress Test is 130000 per year. In many cases your monthly payment will also include other expenses too. 5000 x 036 36 1800 Maximum debt obligation including.

Web At a 700 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 332651 a month while a 15-year might cost 449414 a month. Web Mortgage payments 2927monthTOTAL. Calculations are made using the current interest rate monthly debt payments and other important variables.

Use our required income calculator above to personalize your unique financial situation. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. 113000 12 9417 9417 x 032 3013 Expenses 2982 3013 GDS Keep.

Web In this scenario the minimum income needed for that 500000 condo is 113000 or two salaries of 56500 per year. However some lenders are willing to lend at higher income multiples with some going as high as 5 or 6 times. Web How much would the mortgage payment be on a 500K house.

If youd put 10 down on a 555555 home your mortgage would be about 500000. Web With your monthly household expenses amounting to 3443 this means the minimum income needed for 500K mortgage under the Stress Test is 130000 per year. Thats the general rule though they may go to 41 percent or higher for a borrower with good or excellent credit.

Determining your monthly mortgage payment based on your other debts is a bit more complicated. Web Thats a gross monthly income of 5000 a month. Purchase price 0k 200k 500k 1m Down payment 0k 200k 500k 1m.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. This means that if you wanted to purchase a 500K home or qualify for. The monthly cost of property taxes HOA dues and homeowners insurance.

Web This means to secure a 500000 mortgage you would need an income of between 111111 and 125000 singularly for a sole mortgage or collectively for a joint mortgage. Web Web With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. Were not including any expenses in estimating the income you need for a 500000 home.

This could also be two salaries of 65000 per year. Web As a rule of thumb mortgage lenders dont want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. Web Monthly payments for a 450000 mortgage With a 450000 mortgage and an APR of 3 youd pay 310762 per month for a 15-year loan and 189722 for a 30-year loan.

Multiply your annual salary by 036 percent then divide the total by 12.

Full Article Chapter Six Asia

31 Best Startups Berlin To Watch In 2022 Startups Tips

Here S How To Figure Out How Much Home You Can Afford

Income Needed For 500k Mortgage Overview And Calculator

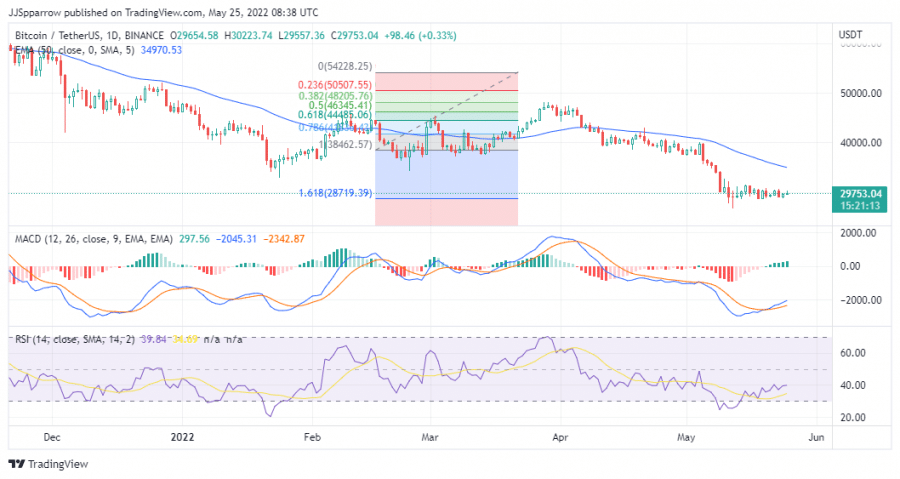

How To Buy Bitcoin In Vietnam 2023 Beginner S Guide

Best New Swedish Online Casinos 2023 Compare New Casinos

Mortgage Income Calculator Nerdwallet

New Mortgage Lending Rules For Canadians Jennifer Gale Real Estate

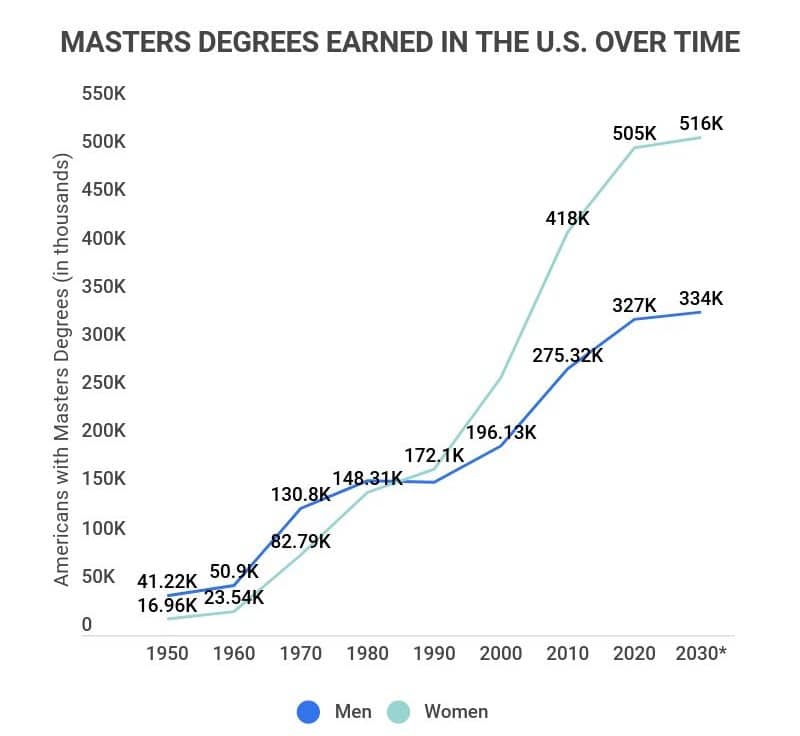

25 Women In Leadership Statistics 2023 Facts On The Gender Gap In Corporate And Political Leadership Zippia

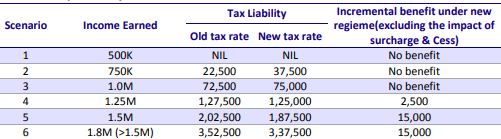

Budget 2020 Analysis Part 3 For The Consumers And Importer Exporter Insideiim

Mortgage Income Calculator Nerdwallet

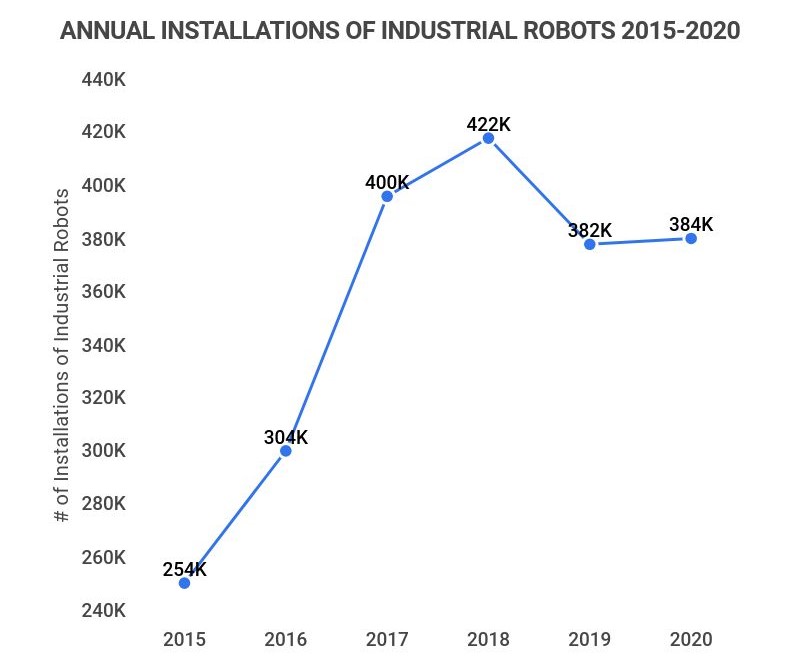

36 Alarming Automation Job Loss Statistics 2023 Are Robots Machines And Ai Coming For Your Job Zippia

425

Homes And Houses For Sale In Texas Har Com

How Much A 350 000 Mortgage Will Cost You Credible

What Is Estate Tax Quora

How Much Do I Need To Make To Afford A 500k House Mortgage Rates Today Com